What Does It Mean to Invest in Private Equity?

Private equity, also known as private placements, represent investments into non-publicly traded entities. This means that an investor provides liquidity, usually cash, to a private company in exchange for a stake of ownership. The term encompasses a myriad of entity structures, including LLCs, LPs, Land Trusts, Hedge Funds, and more.

Why Invest in Private Equity with a Self-Directed Account?

There are several benefits of private equity investing using a NuView account. The biggest one is the potential for high profits when a company has a sales or IPO event. These investments typically do not provide easy liquidity for an investor, at least in the short term, but this lack of liquidity can result in higher yields for the investor, a great trade-off for many IRA holders. Should a private company later go public, the tax-deferred nature of IRAs can keep the funds working without taxation until distribution. Within a Roth IRA, future distribution may be tax-free.

Benefits of Investing In Private Equity

Potential returns - Potential of higher returns compared to public equity markets

Social investing - Invest in companies you believe will make a difference in the world

Better valuations - Private companies are valued much lower than publicly traded ones so essentially you are getting a “better deal”

Build a better future - Help innovative companies shape the future for our children

Invest in what you know - Investing in industries you are familiar with helps limit risk

Private Equity Considerations

Before jumping into any investment, there are a few items to consider.

With any investment, due diligence is incredibly important, and with private equity, it may be even more important. Investors not only need to vet the investment(s) and strategy being deployed, but also the managers and/or operators of the entities and investments. Unlike real estate or private loans, investors are generally giving up control and direct ownership of their account, therefore leaving the onus of investment performance and investor fund management to the entity manager(s). Understanding items like manager(s) background and track record, investment strategy, liquidity opportunities, and exit strategy are all important due diligence considerations that should be reviewed prior to investing.

In addition, it's important for each individual to consider whether a particular investment has required thresholds involving net worth or income. Every investor should work with their financial professional to determine whether an investment is suitable for their particular set of circumstances.

LLCs

Corporations

Partnerships

Start-ups

Hedge Funds

Crowdfunding

REITS

LPs

Types of Private Equities Held Inside IRAs

Getting Started Investing in Private Equity

Set up and fund a self-directed account with NuView Trust

Identify a private equity in need of investors

Submit a Purchase Authorization and loan documentation to NuView

Frequently Asked Questions About Private Equity

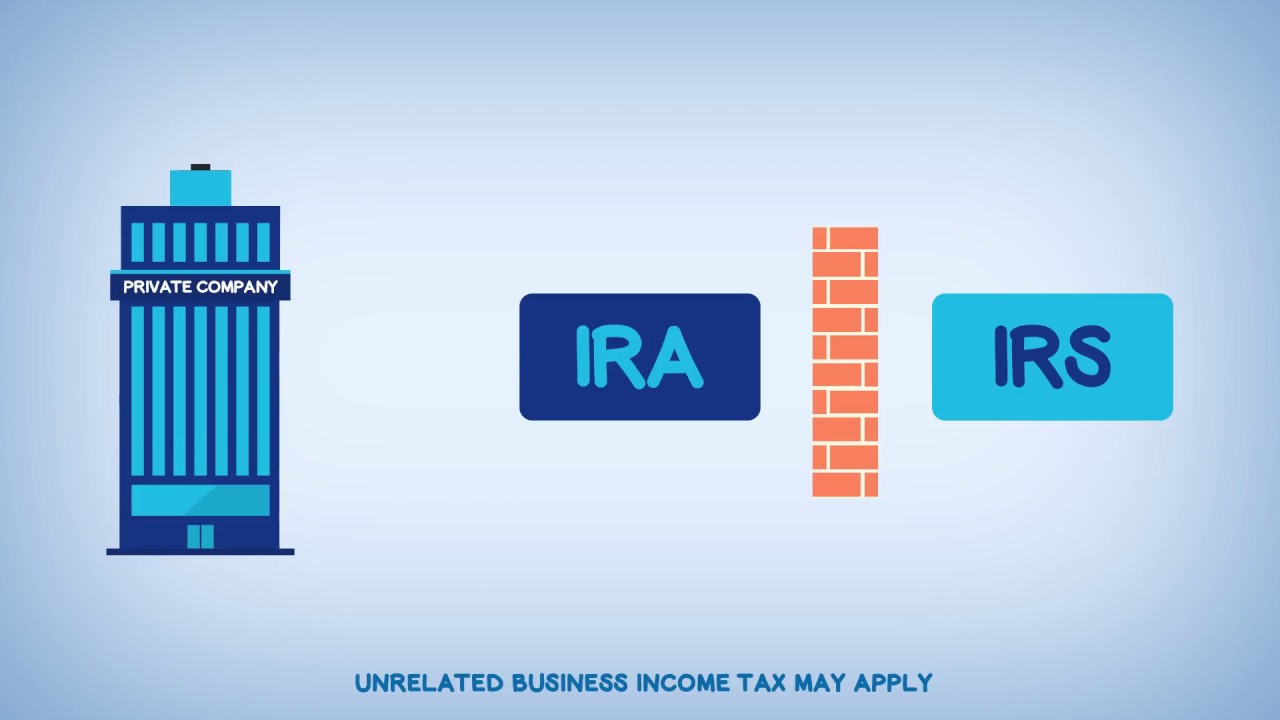

While investments into private companies that are taxed, such as a C-Corporation, will generally not create a tax liability within an IRA, this may not be the case when investing in a pass-through tax entity such as an LLC (S Corporations are unable to take IRA investments). As always, speak with a tax advisor about the possible tax implications of using your IRA to invest in an operational business with a pass-through tax structure, as an Unrelated Business Income Tax liability may accrue. NuView is not a fiduciary and therefore cannot offer investment advice.

As with all investments, the IRA holder should continue to monitor the performance and appropriateness of their investments. At the end of each year, the account holder will provide a third-party valuation of their investment to NuView to meet the requirements of the IRS.

Any dividends or other earnings from the investment belong to the IRA, which can be re-invested as directed. If the funds are invested into an operating company that is a pass-through tax entity, Unrelated Business Income Tax, or UBIT, may be accumulate and must then be paid by the IRA. As always, a tax advisor can provide more information on specific investments.